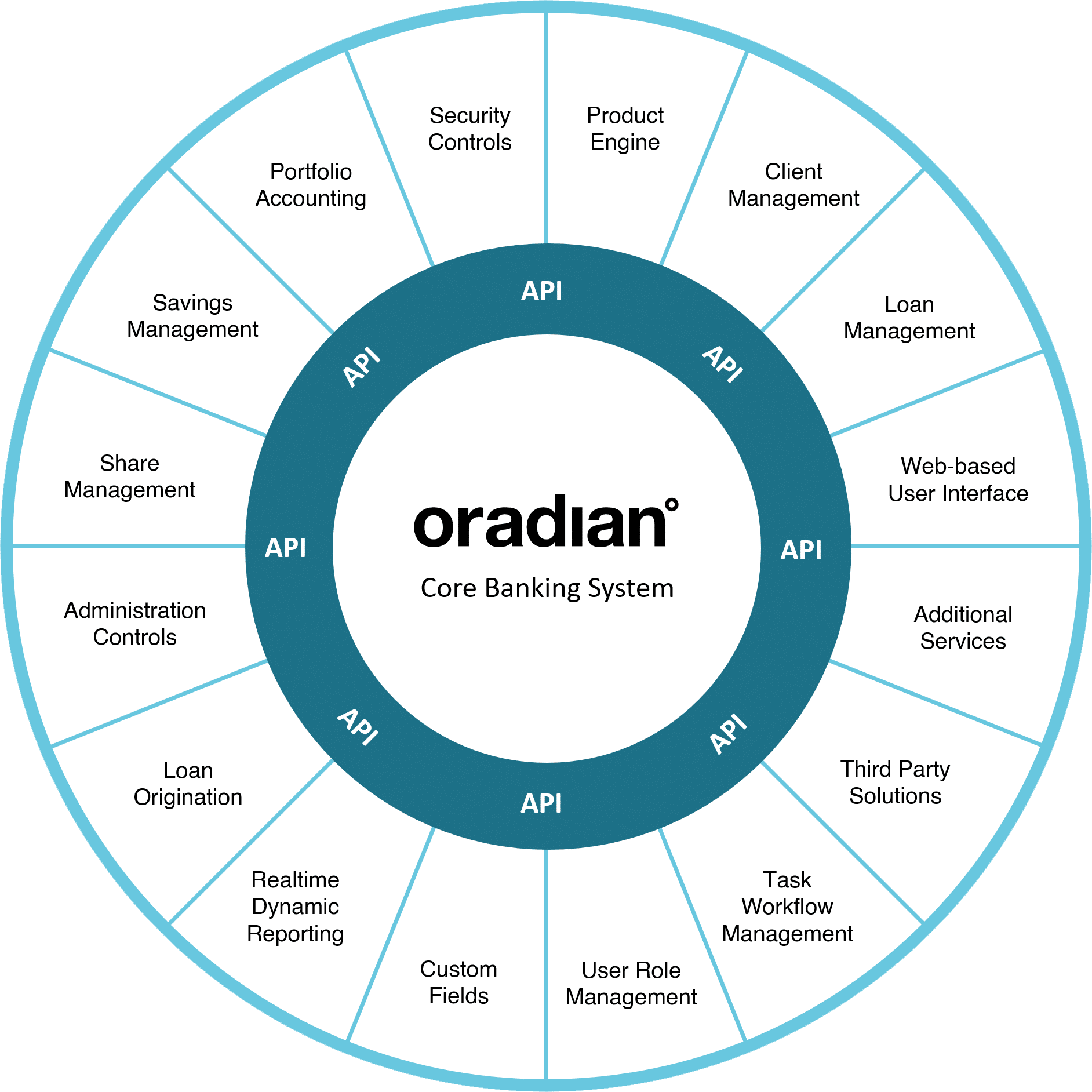

Oradian modules

Oradian provides customers with a core banking and loan management system featuring loan origination, a product engine, loan portfolio management, portfolio accounting, custom workflows, custom fields, client management, real-time dynamic reporting and much more.