Oradian Notifier is an extremely useful tool for Oradian core banking customers. It offers another level of client interaction, enabling financial institutions to deliver push notifications that alert their clients and teams to changes, updates, news, or reminders across their core system.

Notifier is an optional, configurable API integration Oradian customers can use to extend the capabilities of their core banking or loan management system.

What are push notifications?

Most of us are familiar with push notifications. We receive them every day from the apps we use, whether alerting us to a new WhatsApp message or reminding us that a payment is due.

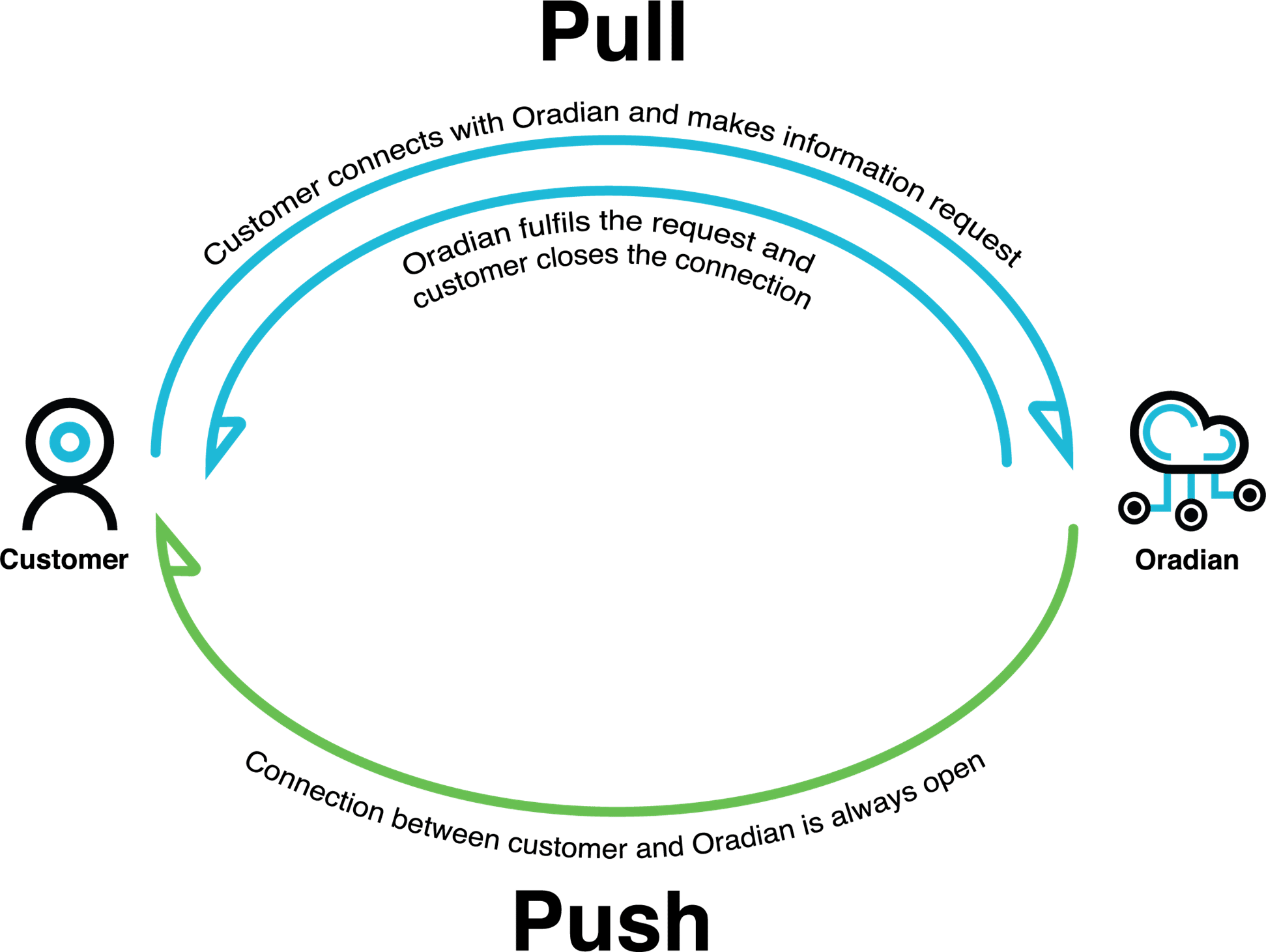

A push notification is “pushed” out to the user by the Oradian server. It is the opposite of a “pull” action because it doesn’t require the user to request the information is sent to them.

For instance, a “pull” action might be refreshing your email application to see if you’ve received any new messages, while a “push” notification will automatically alert you to new emails as and when they’re sent to you.

In the context of the financial services sector, a push notification offers a method for directly engaging with banking customers, for instance by sending important alerts and updates through a mobile banking app that the customer will receive as a pop-up alert on their mobile.

What kind of push notifications can you send?

Oradian Notifier allows users to send real-time notifications using the Oradian system. These push notifications can be sent internally to team members or externally to clients, meaning all users of an institution’s systems are notified any time there’s a change.

For instance, Oradian Notifier can send a notification to specific teams or employees each time a new client is created in the core system, thereby giving an instant reminder to add that client information to Customer Relationship Management (CRM) systems or perform follow-up actions such as onboarding sequences as soon as they receive the alert.

The service also enables automated, API-triggered notifications to clients. This means a financial intuition’s clients can receive a notification every time a transaction happens in the system, informing them when their money is being moved around or confirming when they have made a payment or a withdrawal. The financial institution can also use notifications to automatically trigger their security modules to judge whether a transaction is normal or requires extra scrutiny.

Oradian Notifier can be used for a variety of applications. It can notify clients about new deposits to their accounts, or when their loan applications have been approved, so they know exactly when to go to the bank for disbursement.

All relevant account activity can be clearly and instantly communicated to clients, increasing visibility, awareness, and ultimately client satisfaction.