The leader in growth stage financing across the Philippines, Esquire Financing Inc., has adopted Oradian’s advanced cloud-native core banking system to realise its ambitions for MSMEs across the Philippines.

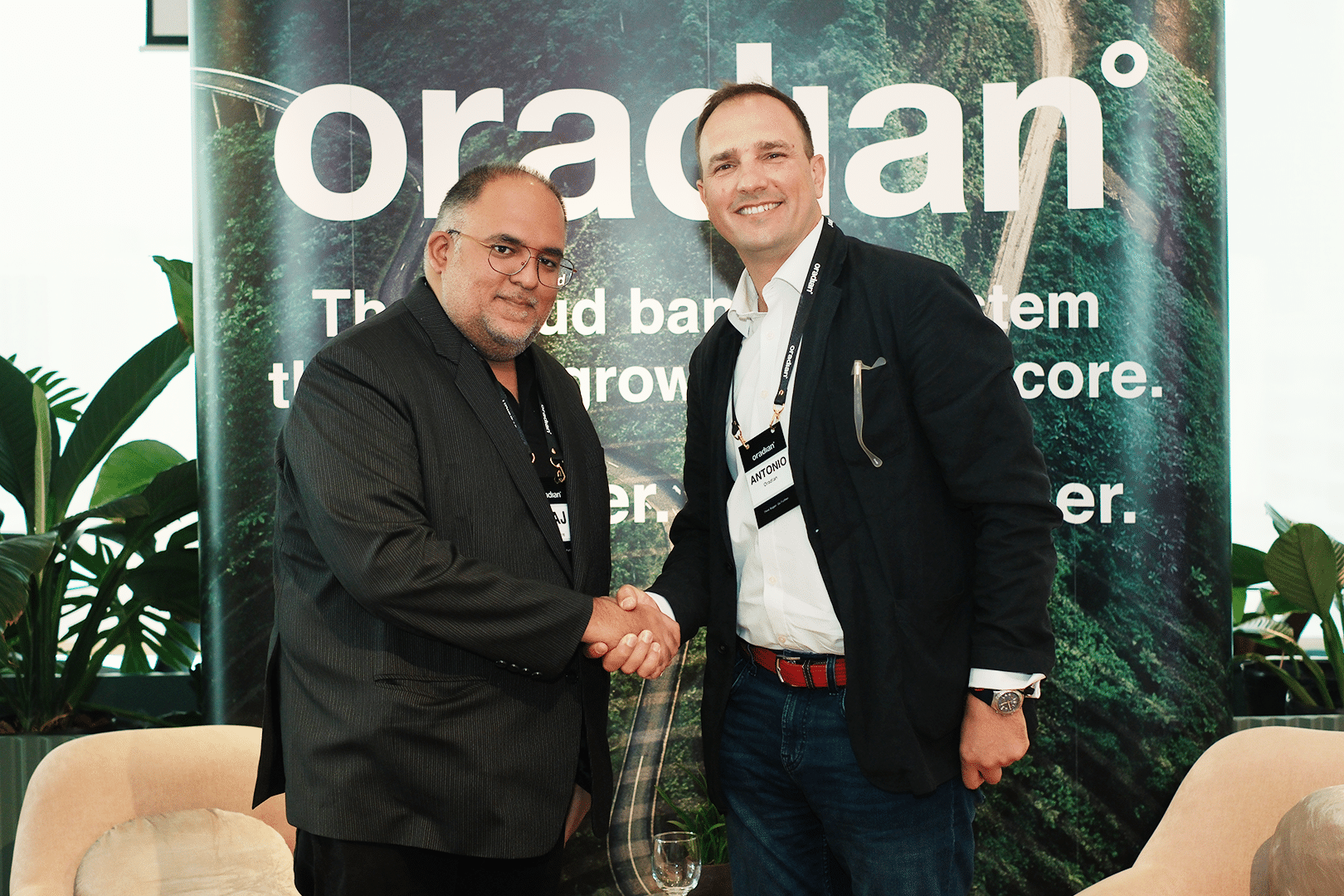

“This new partnership is a critical step towards Esquire’s digitalisation strategy” explained Navin Uttamchandani, Esquire’s President and Chief Operating Officer. “It’s an advanced digital cloud banking platform enabling us to run our back office efficiently and to integrate seamlessly through APIs with third-party financial services, giving us full control of our architecture and business strategy and freeing up our time to focus on our clients and growth”.

Esquire takes a unique approach to lending, offering flexible loan terms with minimal documentary requirements and extremely rapid turnaround times. It tailors its business loans to each client based on sophisticated cash flow analysis. Therefore, Esquire needed a digital platform that could deliver its unique requirements without being bogged down with ongoing developments and large IT teams to custom-develop every required dynamic product.

Esquire Financing chose Oradian’s platform to scale its operations; its goal is to serve more clients and grow its business significantly within the next five years. To do this, it is continually enhancing its processes and efforts towards adopting new technology that will fuel its growth, as well as the dreams of its clients.

“We know from over decades of experience working in the Philippines how technology can help financial institutions navigate a complex, evolving regulatory landscape and the changing market conditions. Our cloud-native service is designed to support and enable financial institutions like Esquire to scale and evolve by utilising the opportunities of the cloud to be flexible and more responsive,” said Antonio Separovic, CEO and Co-founder of Oradian.

“We’re excited to partner with Esquire and earn their trust as they seek to harness the cloud to supercharge their growth and performance and to continue delivering their unique, innovative service to clients across the Philippines.”

Rajan Uttamchandani, CEO and founder of Esquire explained “In an era of the everchanging technological landscape and higher demands from clients, it is paramount to have a trusted partner who delivers on technology and supports you navigate from a business perspective. Oradian demonstrated experience, local know-how and a dominant track record in the Philippines, making them a natural partner.”

About Oradian.

Oradian is the first provider of cloud-native core banking systems to financial institutions and regulated rural banks in the Philippines.

To unlock rapid growth for our customers, we provide a best-in-class, cloud-native core banking system that powers financial intuitions across the globe and serves over 10 million end-clients. Based in Makati, with our local team, we have a personalised relationship with each of our customers ensuing a strong partnership in delivering technology and mutual success for our customers.

We know it takes the right partners, people, and technology to make it happen. Most importantly we enable our customers have a positive impact at scale in their communities.

About Esquire Financing Inc.

Esquire Financing Inc. the leader in MSME growth stage financing across the Philippines, is dedicated to providing tailored financing solutions to small and medium-sized enterprises (SMEs) across various industries. With a deep understanding of businesses’ challenges during their growth stages, Esquire Financing Inc. offers flexible and accessible funding options to fuel their expansion and development.

What sets Esquire apart is its commitment to supporting SMEs throughout their journey. It believes in the potential and vitality of small businesses, and its mission is to empower entrepreneurs by bridging the gap between their financial needs and available resources.

Furthermore, Esquire Financing Inc. values efficiency, flexibility, and integrity and works to ensure these values are present in all its interactions. They prioritise building long-term relationships with their clients based on trust and mutual success.